With the news of Bankaroo shutting down in September, many people may be left wondering what alternatives are out there. Guardian Savings is a great alternative!

Read More“How much money is in the piggy bank?” … you'll have to wait five minutes while your child counts all the bills and coins and then another five because they lost count halfway through. Does your child want to buy something at the store? The piggy bank is at home so you’ll have to deal with an upset child or an IOU of questionable reliability. It’s finally time to retire the 600-year-old piggy bank.

Read MoreFour years ago, we started GS with a vision for how we could help parents raise money-savvy kids. While we hoped to always offer the app for free, our personal out-of-pocket costs have increased beyond what our personal budgets can sustain. Because of this, the next time you login to the parent area, you’ll be asked to choose a subscription.

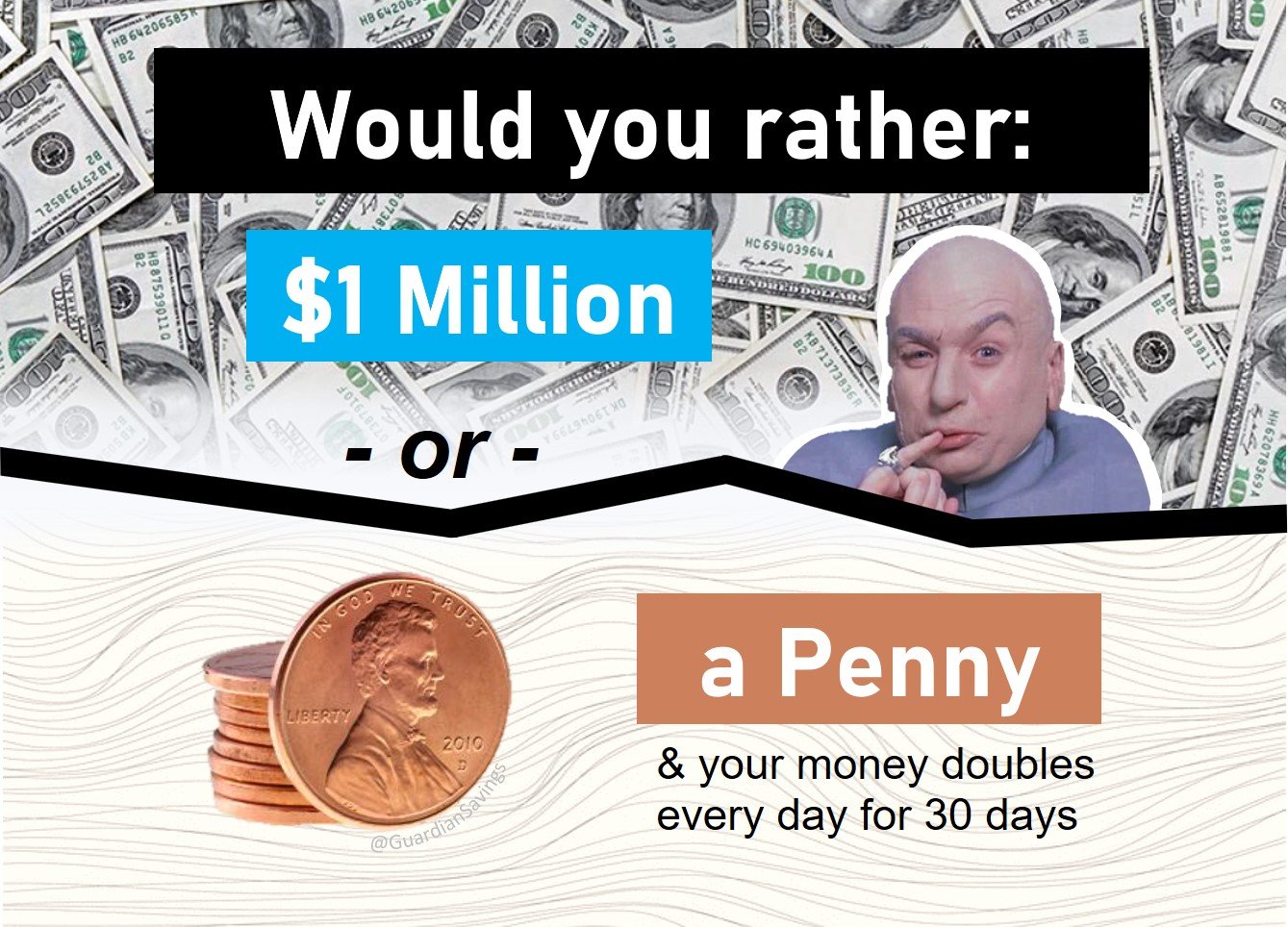

Read MoreWould you rather A) start with a penny and have your money double in value everyday for 30 days or B) just receive $1 million now?

Read MoreSince launching to the public in January 2021, the app has taken off, with over 500 families logging more than 50,000 deposits and withdrawals. User growth has increased over 250% in the last three months as more and more parents discover the advantages that Guardian Savings has over traditional tools like the piggy bank.

Read MoreAllowance can be difficult to give - you want your child to practice spending and saving but you also don’t want to watch your children throw away the money you give them on silly purchases. How does one balance these two conflicting feelings? A good compromise is the save, spend, share allowance.

Read MoreWith the news of Rooster Money leaving the US and all countries besides the UK, many people may be left wondering what alternatives are out there. Guardian Savings app can fill the gap!

Read MoreInterview between Guardian Savings co-founder, Erik Neighbour, and podcast host Dave Swillum from the “Waking up from work” podcast. Erik shares his inspiration for Guardian Savings, approach to app development, and vision for the future.

Read More“Mom, Dad, can we buy this?” This is a question parents are frequently confronted with and can be the start of a slippery slope towards an impulse purchase. But stopping impulse buying on family shopping excursions isn’t as simple as telling your child no, or you shopping alone. Instead, it should be an opportunity to teach your kids how to replace the temptation of impulse buying with healthier habits.

Read MoreSome kids’ hands get sweaty just thinking about spending their precious savings. Others can’t seem to go a day without blowing through their allowance. Different kids have different money personalities. Discover which one your child has so you know how to coach them best!

Read MoreAnnie Gibson, an elementary school teacher from Indianapolis, shares her perspective on the benefits of learning personal finance at an early age. She describes how "schemas", imitation, and low-risk practice environments help people learn.

Read MoreMost of the news during financial literacy month covers adults - and rightfully so. Roughly half of American adults can’t afford a $1,000 emergency! What many don’t realize is that part of the personal finance crisis in America is due to inadequate teaching. Not convinced? We’ll make the case for why it’s important and share tips for how to start teaching your kids today.

Read MoreAs a dad and a financial advisor, I find myself constantly trying to explain how money works. In my opinion; budgeting, investing, and creating income are topics that should be equally important to my 8-year-old daughter as they are to a 50-year-old client. Unfortunately, for whatever reason, access to financial literacy tools for money management are not a mainstream part of our educational system.

Read MoreWith the Corona Virus shutting down a lot of norms, you may have a lot more time at home and more family time than normal. Focusing on this as a positive, here are a few money-related activities and questions which you can do/ask your kids to stay engaged and keep learning. We hope everyone stays safe and healthy!

Read MoreYou have a dream for something that you wish you could afford: a new car, a house, jewelry, a trip of a lifetime. You do some planning and realize that if you control your spending, you’ll be able to save enough money to realize your dream. However, sticking to a budget can be tough! This one trick will help you get on track.

Read MoreAlbert Einstein is the name that a lot of people think of when asked to name a ‘genius’. He’s most well known for his theories in relative physics, however, he also had wisdom for personal finance. Read on to learn what Einstein considered “The 8th wonder of the world” and why it’s important.

Read MoreThe lottery, inheritance, dumb luck. These are some ways millionaires can be made. But most of us won’t hit the jackpot, so let’s talk about the next best thing - marshmallows. Why? Because no matter how you feel about marshmallows, they teach us important lessons about the value of goal-setting and delayed gratification, the more common paths that lead to financial success. Want s’more?

Read MoreTaking on a teaching gig is not Brandon Copeland’s first venture off the football field. During his undergraduate career he interned at UBS, a prestigious investment bank. During the early days of his NFL career he traded stock options and flipped houses in Detroit. These experiences helped him strengthen his conviction that everyone needs to be financially literate.

Read MoreSummer can be a special time for children to learn the life skills they may not be able to find inside the classroom, like an appreciation for nature, the value of making new friends, or the grit needed to stick with a summer job. It’s sometimes difficult to find age appropriate jobs for elementary and early middle school aged children - that's why we put together a list of our top five jobs for grade school kids.

Read MoreMen are more likely than women to self identify as knowledgeable in financial matters like, money, budgeting, managing expenses, and investing, according to T. Rowe Price’s *Family Finance Report. In the same study, parents said they were more likely to talk about money to their sons than to their daughters.

Read More